Flipkart PayZippy - Online Payment Gateway For Indian Merchants

PayZippy uses world class encryption technology to save your card information. Flipkart's already obtained PCI DSS (Payment Card Industry Data Security Standards) which basically is a certification of the security of the digital data. Signing up on PayZippy is easy - and all you need to do is create an account one time with your email ID or mobile number. Once your account is created, you will have to link your card with your account and you're done. The sign-ups are expected to begin soon!

The service will accept credit and debit card (MasterCard, Visa, Maestro) and Flipkart's currently working on enabling Net Banking, AmEx, Diners and EMI options into their service. The FAQ page says that all of these services will be launched very soon.

The service also supports international payments, but you'll have to get special permissions from PayZippy team to enable it.

Sachin Bansal, co-founder and CEO of Flipkart said, "Flipkart has enabled e-commerce in India over the last six years. Throughout our journey we were always looking to build solutions that could empower the whole ecosystem and not just Flipkart. Flipkart’s Marketplace & Payzippy are the first two examples of this. This is an exciting beginning”.

The service promises higher conversions through smart transaction routing and intuitive payment experience. Users without a PayZippy account will be able to enter their card details without leaving your website. The service works with mobiles and tablets and offers an innovative mobile optimised UI for payments.

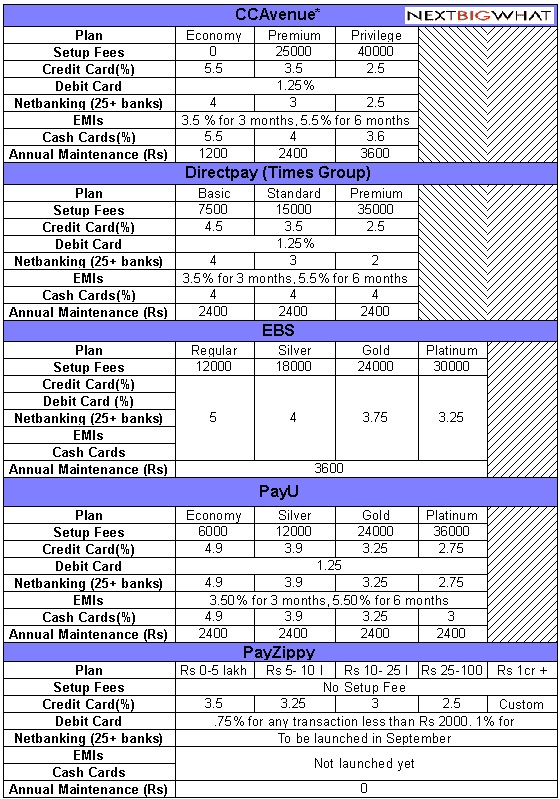

The most important question is about Pricing. We're impressed with what Flipkart's come up for the merchants -

1. There is Zero Sign Up Fee.

2. There's no Annual Maintenance Fee

3. No other hidden costs.

For Debit Cards -

0.75% of the overall transaction value for orders < Rs. 2000.

1% for the transactions over Rs. 2000.

For Credit Cards-

Monthly Transaction | Pricing

1. Rs. 0-5 Lakh | 3.5% (Promo: 2.5%)

2. Rs. 5-10 Lakh | 3.25% (Promo: 2.25%)

3. Rs. 10-25 Lakh | 3% (Promo: 2%)

4. Rs. 25-100 Lakh | 2.5% (Promo (2%)

5. Rs. 1 Cr+ | (Get Custom Quote From Flipkart)

Our take - Well, we aren't surprised! The speculations that Flipkart will eventually enter into Payment Gateway services have come true. The ever dabbling Indian ecommerce markets require the players to exercise control over the payment systems across the ecosystems and the launch of PayZippy is a very logical step in the right direction. The pricing they've come up with is definitely attractive and should attract merchants to use it. It'd be more interesting to see how this new development helps Flipkart step up their game against the international bulldozer - Amazon! We're all ears to your opinions.