Administrator • 10yrs

"Tax planning is just as important as exercising."- Vikram Ramchand ,MakeMyReturns

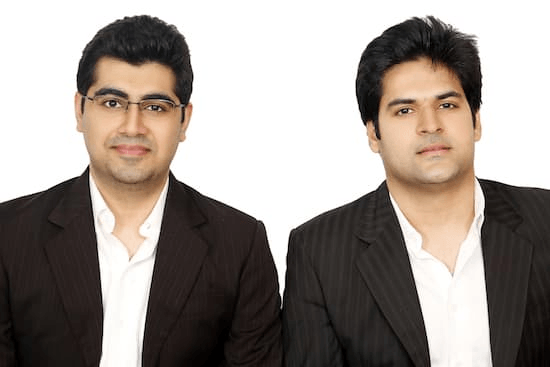

Founded in 2011 by Vikram Ramchand, Aashish Ramchand and Varun Advani with the passion to make amazing innovations every day, the startup called 'MakeMyReturns' has built an online tax filing service for Indians, NRIs and companies.

Vikram Ramchand is the current chief innovation officer. He has already jumpstarted two successful start-ups. Having a bachelors' degree in Computer Science from the Georgia Institute of Technology, Atlanta, Vikram went on to get an MBA from the London Business School. Aashish Ramchand who is the company's CEO is a Chartered Accountant and a CFA Level I by profession with 5 years of tax advisory experience, while Varun Advani is the COO and an aspiring Chartered Accountant.

In an exclusive interview with Vikram Ramchand, we dig into the details of MakeMyReturns and get some information on financial management and tax returns. Vikram shares with us his passion, various lessons he learnt in his entrepreneurial journey so far and the questions any aspiring entrepreneur should answer before taking the big plunge.

Please read the following interview to know more.

CE: Could you please tell our readers more about makemyreturns.com?

Vikram: Makemyreturns.com is an online tax e-Filing service built and created by JRC Technologies Private Limited. It specializes in providing tax-filing solutions to Salaried Employees, Self- Employed Professionals and Non Resident Indians with taxable incomes in India. The technology is built on the back of over 60 years of cumulative tax advisory service experience – thereby equipped to deal with the most complex tax situations. We also provide special emphasis on assisting our users with various tax planning techniques. We believe in simplifying not just the tax filing process but also the entire tax planning process, as currently, taxation is one matter where the perspective of many people is still that of fear and hence they try to avoid it as much as possible.

CE: What was the source of inspiration behind makemyreturns.com? How did the team come together?

Vikram: The source of inspiration truly lied in simplifying the tax filing process for one and all. We've spent years going through the same problems and frustration while trying to file our tax returns via the income tax department portal. The problems varied from complicated XML uploads to unresponsive income tax department servers and more, till we decided that there had to be another way and we had to do something about it.

Teaming our tax know-how with a little bit of tech know-how, we found a new way of tax filing that was easy and simple. And like any convert, once we found this way, we wanted to share it with everyone. Everyone behind this service is passionate about the Internet and income tax.

I hold a Bachelors degree in Computer Science from the Georgia Institute of Technology and an MBA from the London Business School. To put it simply I’m the techie in the mix. Aashish Ramchand is a chartered accountant by profession with years of experience in taxation. He has previously worked with KPMG and Ernst and Young. Aashish builds the knowledge base for makemyreturns.com. He’s the tax genius in the mix. Varun Advani is a budding chartered accountant. He is the brain behind the complex tax algorithms devised at makemyreturns.com. Putting together our team was the simplest part actually. Its was a simple dinner table conversation at the end of which all the three of us knew what we had to build and our respective duties towards makemyreturns.com

CE: What would be your advice to engineers who have little or no knowledge about income tax returns and finance management in general?

Vikram:

Please be more pro-active with your taxes. Tax planning is just as important as exercising. Nobody wants to work out but everybody wants to be fit. Similarly everybody hates paying taxes but nobody wants to pay much heed to tax planning.

Planning your taxes doesn’t require as much effort or time as one might think. All you need to do is have one telephonic conversation with our tax experts. Based on your income, the expert will determine your tax liability and accordingly guide you as to the investments you need to make to reduce/nullify the same. The investments vary from life & health insurance to specific tax saving schemes in the equity market. The process of tax filing begins where that of tax planning ends. When you file your taxes, you are simply summarizing details of your income & tax deductions. One misconception that prevails is that if tax is correctly deducted at source as per one’s form 16, then there’s no need to file your taxes. This is completely incorrect and illegal. You must file your taxes even if tax is correctly deducted at source. And to help you through that process, makemyreturns.com is always at your service.

CE: How difficult was it to make people do things online they are used to doing offline?

Vikram: The income tax department has made it mandatory for all those people having an income of more than INR 5,00,000 to file their returns electronically. Therefore in our case the transition from offline to online was rather smooth as everyone was liable to file his or her tax returns, electronically. However even before the same was made mandatory, people voluntarily had started making the transition as the online mode was faster and hassle free. When you e-File your income tax returns you are not liable to attach any documents as proof vis-à-vis the offline mode. But the biggest advantage would have to be the faster processing of refunds. People who have e-Filed their tax returns via makemyreturns.com have received their refunds with 6-8 months form the date of filing their tax returns.

CE: Could you share the lessons you have learnt as an entrepreneur while starting building and growing makemyreturns.com?

Vikram:

The biggest lesson I believe I’ve learnt throughout my journey so far is that I should “never stop learning”. You must have the willingness to constantly keep learning. You should be like a student grasping whatever knowledge you can get from every corner possible.

CE: A good business idea is rooted in something you are passionate about. Could you cite an example?

Vikram: No better example that makemyreturns.com. As I mentioned earlier, the only source of inspiration was that of simplifying the tax filing process for one and all. That was our only goal and passion. I’d like to believe that so far we’ve been successful in achieving that. It feels very nice when people recognize that effort that has gone into building makemyreturns.com. It feels even better when our users shower us with good reviews on our Facebook page. We aim to maintain those standards constantly and consistently. We're also workaholics, so like Google, we're always there for our users.

C:E What are the important questions any aspiring entrepreneur should try to answer before taking the plunge?

Vikram:There are three very simple question any aspiring entrepreneur should answer before starting any venture, Who, What & Why?

- Who is my target audience and how can I reach out to them?

- Why would anybody opt for my product/service over my competitors?

- What do I plan to achieve with my product/service 5-10 years hence?

Once you successfully answer these questions, you’ve won yourself half the battle. The rest is simply about executing your plans in a complete and efficient manner.

C:E How should an entrepreneur handle criticism? Have you been in a situation when nobody believed in you and your big idea?

Vikram: One should handle criticism constructively. It gives you a chance to introspect on what you’ve done. It helps you to self evaluate your actions. I’ll give you an example to illustrate – In our first year of operations, whenever any user would upload his/her form 16, we would have a data entry operator and the back end who would manually input all the data as per the form 16 in the user’s income tax return. The data entry operator would then notify the user regarding details being updated.

The entire process took about 15 to 20 minutes. However this process during the peak season would take 30 to 40 minutes per user as the sheer volume of tax filers during that season were overwhelming. Therefore ideally it was the backlog that increased the processing time. We received many complaints from our users that the time taken to complete their tax filing process was too long. We then used that criticism, constructively to overhaul our system for the benefit of our users. As a result when you now upload your form 16, our system automatically extracts data from the form and populates the necessary fields in your tax return and the average time taken to file your income tax return has dropped down to 10 minutes.

When you start any venture you will find many people playing the devil’s advocate. Many might be quick to dismiss your idea completely. These inputs, I believe are extremely important in building your product. It is almost like getting feedback from your consumers even before they’ve actually used your product/service. You are bound to find someone who disagrees with your idea, but you must be willing to take it in your stride. Make amends if required, but don’t lose hope.

CE: Thank you for your time. Any message for our readers?

Vikram: A big Thank you to the team of CrazyEngineers.com who found us worthy of this interview. As a parting message I’d only like to urge all your readers to take their taxes more seriously. For all of your taxation needs, visit makemyreturns.com because your taxes need our experts.